10 – PITCH DECK ASK SLIDE – 10 SLIDES TO VC FUNDING SUCCESS

10: Pitch Deck Ask Slide – 10 Slides to VC Funding Success

❏ Today, in Part 10 of my series on 10 Slides to VC Funding Success, I’ll speak on 10: Pitch Deck Ask Slide: 10 Slides to VC Funding Success.

The tenth page of every successful VC pitch deck is the Ask Slide. After discussing the team slide, it’s time to close your presentation with a discussion on the funding needs, which is the job of the ask slide.

What is the Ask Slide? You will learn in this article the answer to this question and what is essential to show on your pitch deck.

My History:

One of my responsibilities as an executive coach is to assist company founders with creating their investor pitch deck. Throughout my career, I have made and reviewed many investor pitch decks. Upon reflection, I realized that some of our team’s investor pitch decks, especially early in my startup career, were “horrible.”

Sometimes, our teams were successful in raising money from investors. Many times, they were not.

I never thought that the content and presentation style of the investor pitch deck might be hurting us. Boy, was I ever wrong? Working with many investors taught me what they want in an investor pitch deck. In my last company, we raised $87 million over rounds A, B, and C.

So, in this series and an upcoming book, I look to share my hard-learned lessons from 20+ years of being an entrepreneur.

The Investor Pitch Deck Series:

In this series, you will learn the order and importance of each of the following pitch deck slides:

- Cover Slide

- Problem Slide

- Market Slide

- Solution

- Traction

- Competition

- Monetization

- Financials

- Team

- Ask

The ideal content, flow, and order of the ten investor pitch deck slides are covered in this 10-part series. You will now know how to turn your narrative into a compelling ten-page investor pitch deck to help you secure funding!

When entrepreneurs assemble their investor pitch deck, they usually gather a hoard of information. Sadly, they often construct a “book” that is 20, 30, or even as much as 80 pages long! Most people have worse attention spans than entrepreneurs. Even ad networks know that most commercials that last longer than 30 seconds are ineffective with viewers. An investor pitch deck should have ten pages and a presentation duration of seven to fifteen minutes to succeed.

Pitch Deck Ask Slide – Why Important?

Last week in Pitch Deck Team Slide: 10 Slides to VC Funding Success, I spoke about the team slide and its importance. This week, I’m talking about the Pitch Deck Ask Slide, the tenth and final page of the investor presentation, and its significance. After talking about the team slide, it’s time for you to close with your funding needs.

Why? If the audience has been “sold” on your idea, they want to know, “What will it cost me?”.

If you’ve followed this series and your investors are in your market space, they’ll be on the edge of their seats!

Pitch Deck: Ask Slide: Content

Most of the Ask Slides I see from entrepreneurs are slim in details! They say, “I need only a $100,000 investment.” The rational response from investors is, “That’s nice. “What do I receive?” Some others I have seen state, “I value the company at $5 million, and I need $100K.” Investors say, “All right, so you have a marginal minimum viable product (MVP), no customers, and no sales.” You have yet to progress and are only giving me two percent of the business. Either you are high on drugs, or you are insane!”

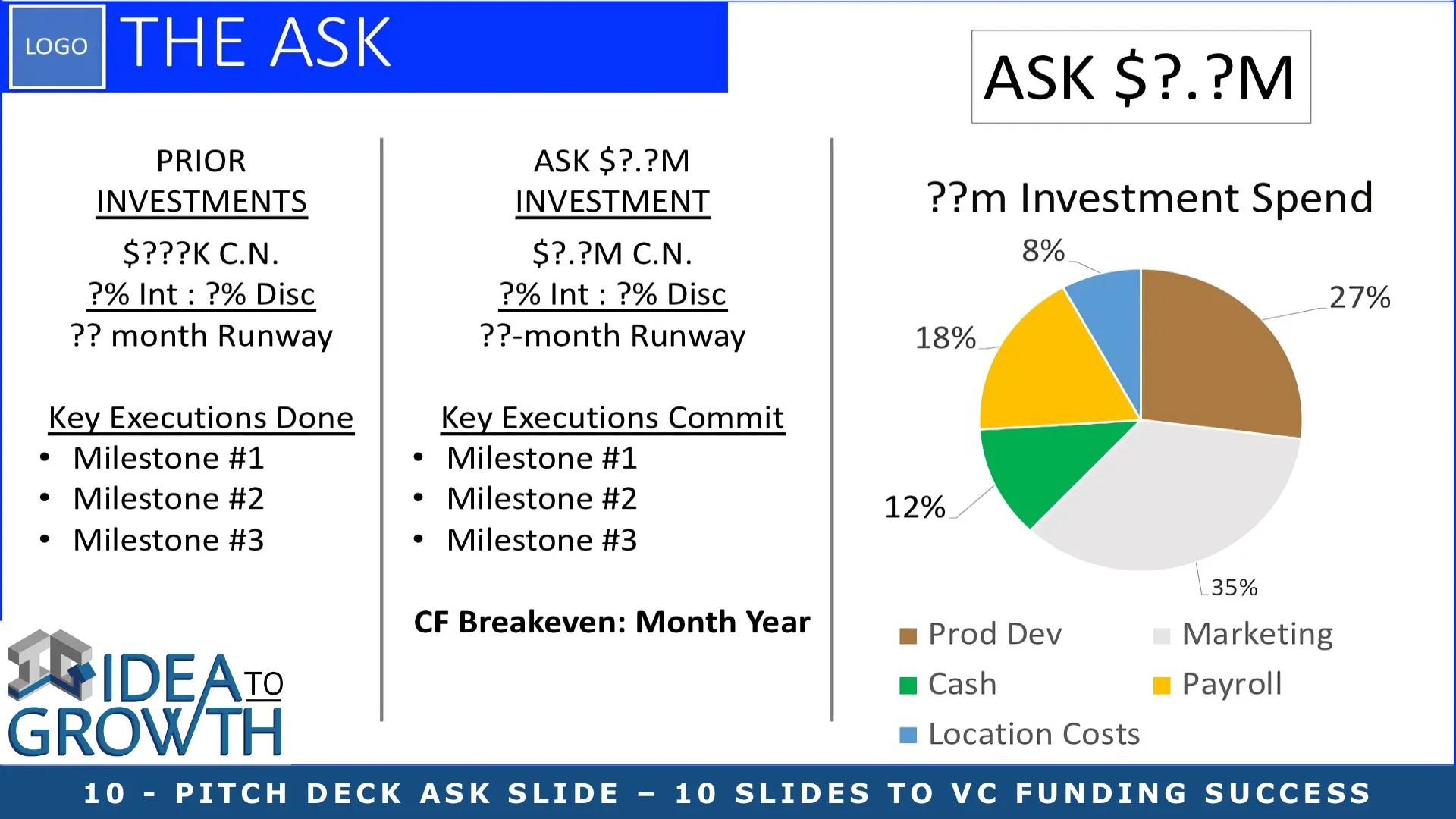

A few essential details should be communicated on your pitch deck. First, how much cash are you trying to raise? Secondly, to what extent have other investors committed? Thirdly, are you looking for funds backed by company stock or a convertible note? Fourth: (percentage per entity) Who owns the company’s current shares? Fifth, for what amount are the other notes outstanding? What is the “runway” number of months that his investment gives the business? Seven, with this funding round, what three “hard” commitments will you be able to fulfill?

For many investors, the final item—three “hard” commitments—is crucial. These three “hard” commitments you and the team commit to complete with this funding are crucial. These three “hard” commitments as an investor will determine whether or not I send you a check.

A “hard” commitment: what is it? A “hard” commitment is an action that is clear and measurable. The goal is “hard”: “Have 300 monthly recurring revenue clients by October 2018.” “Increase our sales” is not a commitment that is “hard.” It is a “hard” commitment to “hire a VP of Sales by May 2018”. The decision to “hire a search firm to find a VP of sales” is not “hard.” The “hard” commitment is to “reach $100K in Monthly Recurring Revenue (MRR) by July 2018.”

Ask Slide in Pitch Deck: What is Your Story?

So, what could you say while your Ask Slide is visible? You will tell me the seven critical points outlined in the content paragraph above. I recommend speaking to each one in the order I’ve listed.

Allow me to give one pitch example.

“We have raised $50,000 through a convertible note from friends and family. The interest rate is 5% with a 20% discount. We are raising $150,000 this round as a convertible note under the same terms. The three founders hold all the company stock equally, with 10% set aside for new hires. This round will give us nine months of runway. We commit to accomplishing three key goals. One, reach $25K MRR. Two: add our services in Atlanta, GA, and Miami, FL, with $10K+ MRR each. Three, release the iOS and Android versions of our service.”. You’ve covered all seven key points. Now, the intelligent Q&A is ready to begin.

Presentation: We Can Read or Listen – Not Both!

Most of us humans can either read or listen, but we cannot do both at the same time. Your Pitch Deck slide presentation exists to support “the story” you will be telling your audience. Does your investor pitch deck have a lot of words, charts with numbers, or distracting images? Then, your audience will switch their brains into reading mode and out of listening mode. As soon as that happens, you’ve lost your audience and will struggle to get them back to listening to you! To avoid this, use primarily images and as few words as possible, usually in bullet form. So absolutely, positively, no sentences!

Conclusion

So, I suspect many of you were surprised concerning the importance of the Ask Slide. If you’re starting to create your first investor presentation, congratulations! You will start on the right foot if you follow my recommendations above. You can go back and look at your Ask slide and apply what you’ve learned above. You should wait to read the remainder of the series before you present it again. I can promise you a better reaction from your audience.

100% FREE GOOGLE PAGE RANK ANALYSIS

I want to prove my value to “Helping You Grow Your Business Stronger!” by offering a 100% free Google SEO pagerank analysis. Could you share your homepage URL (domain name) and the email to which I should send your 100% free report? Within a day or two, I’ll point out the top items on your business website that cost you customers.

QUESTIONS?

If you’re ready for an F2F Zoom chat or want to ask a quick question by email, click the appropriate link below.

Regards,

Kenneth Ervin Young, CEO

Idea To Growth LLC

Digital Marketing and Website Agency